Although some financial gurus like Dave Ramsey recommend avoiding them altogether, credit cards can help you establish a credit history. You’ll need a good record of credit when it comes time to finance large purchases like a car or home. When I was a college senior, my parents let me get a Discover card. I paid off the debt for every month I had a balance and was never late with payments. Thus, I began my credit history.

Not carrying too much debt, not having too many credit cards, paying your utilities and rent on time, and never being late on credit card payments are some major ways you can build a good credit history. And like I’ve preached before, try to pay off your whole credit card balance each month. Not only will you avoid paying interest on the unpaid balance, but it makes for a good habit of staying within your means.

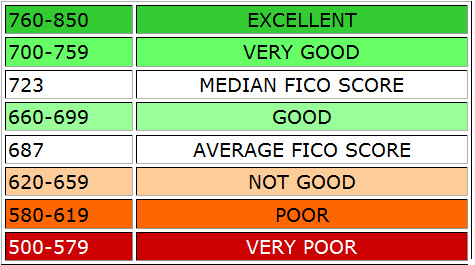

Your credit score is derived from your credit history (also called a credit report.) It is a numerical representation of the health of your credit at any point in time and also an indicator to prospective lenders of how much of a risk you are as a borrower. Avoid pulling a credit report on yourself too often, and make sure you’re doing so with a reputable online vendor.

The three credit bureaus are Equifax, TransUnion, and Experian and all will have a slightly different score for you. These numbers are fluid and will change over time depending on your spending habits, how you handle your credit, etc. And here’s how to request your credit score from the three bureaus . Here’s how your score is calculated:

35% – Payment history

30% – Amount owed vs. total credit available to you

15% – Length of credit history

10% – New credit

10% – Types of credit used 1

And here are what the score ranges mean: 2

If you tend to forget payments, create recurrent reminders in your phone or calendar, or set up automatic payments that draft your checking account. Definitely avoid allowing a bill to become so overdue that it’s sent to collections. Again, like with a lease, if you see that for some reason you will not be able to make a full payment, work with the lender on the best course of action instead of letting it go overdue, which can negatively affect your credit score.

Don’t max out your card, spending up near the limit. 3 Just because you have a high limit doesn’t mean you should take advantage of that regularly or with too many purchases of non-necessities.

Making good financial choices isn’t always easy. But being informed, staying on top of your finances, and guarding your credit history will keep you on the path of financial stability and maintain your good reputation as a borrower (not to mention lowering your stress!)

References: 1Myfico.com 2usleaseoption.com 3regions.com/mygreenguide

Don’t miss a thing. Subscribe to receive updates by email.

Looking for a new job? Want to get the one you want faster? Check out my new book, Here Today, Hired Tomorrow.